If you find that your current financial savings are insufficient to handle unforeseen costs, in search of an Emergency Fund Loan may be a wise alternative. However, guarantee that you've a plan for reimbursement, as these loans can carry interest rates that will accumulate over t

Borrowers must also contemplate the associated costs with each Loan for Credit Card Holders kind as they vary considerably. Personal loans are inclined to have decrease rates of interest, whereas payday loans can outcome in excessive charges if not paid on time, making it crucial to weigh the monetary implicati

Potential Risks of Employee Loans

While employee loans present significant advantages, in addition they include potential dangers that borrowers ought to contemplate. One of the first dangers is over-leverage. Employees may discover themselves in a precarious monetary situation in the event that they take on extra debt than they'll moderately repay, resulting in further financial mis

n If you leave your job whereas having an excellent employee mortgage, the remaining stability may be due instantly. This can range by employer, so it’s important to evaluate the terms of your mortgage agreement. Communicating with HR can provide readability on the insurance policies related to loan compensation upon terminat

In conclusion, understanding credit-deficient loans is essential for navigating the borrowing course of efficiently. This monetary solution can open doorways for lots of individuals seeking help, but it is important to method it with knowledge and warning. Utilizing sources like 베픽 can equip debtors with the information needed to make informed selections, making certain a more secure monetary fut

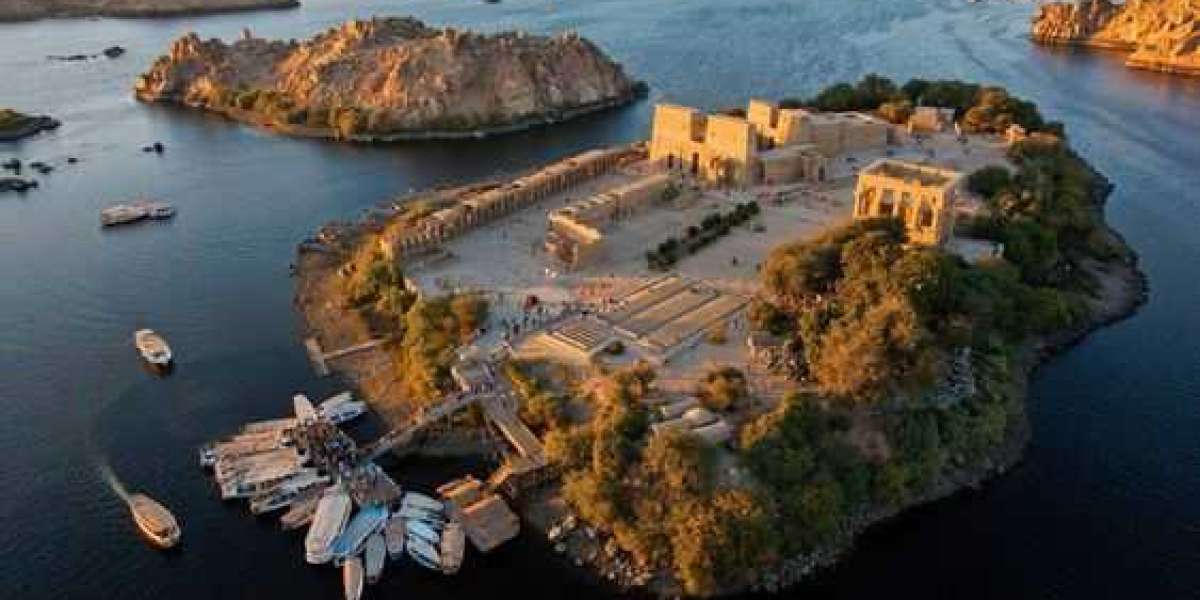

Understanding Real Estate Loans

Real property loans are specific forms of financing designed for buying properties or refinancing existing mortgages. These loans can be categorized into various sorts, every with its own standards, benefits, and disadvantages. A complete understanding of these loan varieties is essential for making informed financial selections. Conventional loans, usually backed by non-public lenders, require a down fee and have set phrases. On the opposite hand, government-backed loans, 이지론 similar to FHA loans, are tailor-made for lower-income borrowers, enhancing accessibility to homeowners

Moreover, the location often updates its content material to mirror the most recent tendencies and changes in the no-visit loan market, ensuring users have entry to probably the most present info. This makes Bepec an essential start line for anybody interested in exploring no-visit loan choi

What is an Emergency Fund Loan?

An Emergency Fund Loan is specifically structured to assist individuals handle surprising expenses with out the stress of long-term debt. These loans sometimes have a faster approval course of, allowing borrowers to entry funds quickly. While the quantities and terms could differ, the principle concept is to provide instant assistance during a monetary cru

Credit-deficient loans discuss with borrowing options tailor-made for people who do not meet the usual credit requirements set by traditional lenders. These loans cater primarily to these with low credit score scores or those missing an sufficient credit history, making traditional banks hesitant to approve their purposes. The goal of those loans is to supply financial assistance to those that may in any other case be excluded from mainstream financing choi

No-visit loans have emerged as a handy financial solution for many individuals looking for fast entry to funds without the trouble of in-person conferences. This progressive borrowing method caters to those who value efficiency and adaptability in their monetary transactions. Whether for unexpected bills or deliberate purchases, no-visit loans permit for streamlined applications and approvals, making them an appealing choice. For those interested in exploring this subject further, Bepec stands out as an informative platform providing detailed insights, reviews, and comparisons on varied no-visit mortgage choi

To build an emergency fund, start by setting clear financial savings objectives based on potential bills. Automate financial savings by transferring money often out of your checking account to your savings account, even small amounts can add up. Aim to keep away from wasting at least three to six months’ price of residing bills for future emergenc

If you encounter difficulties in compensation, it's crucial to communicate along with your lender as soon as possible. Many lenders offer options corresponding to mortgage modification or deferment. Seeking assistance from a credit counseling service can also present priceless guidance and help to handle your debt successfu

Community assist also can alleviate emotions of isolation usually skilled in financial undertakings. Sharing experiences with others in related situations can foster a way of solidarity and collective empowerment, in the end making it simpler for women to access the loans they need to achieve their targ

brentoncain158

1 Blog posts