Bank statements are like financial snapshots, capturing your account activity for a specific period. While they might seem cryptic at first glance, understanding them empowers you to manage your money effectively. This guide delves deep into the content of bank statements, breaking down each section and its significance.

1. Statement Overview:

- Account Information: This section displays your name, account number, and statement period (usually a month).

- Account Type: Identifies the account type (checking, savings, etc.) and any linked accounts.

- Current Balance: Shows your ending balance for the statement period. This is crucial for tracking your overall financial position.

2. Transaction History:

This is the heart of the fake bank statements, detailing all debits (withdrawals) and credits (deposits) that occurred during the period. Each transaction typically includes:

- Date: Indicates the day the transaction occurred.

- Description: Briefly explains the nature of the transaction. This could be an ATM withdrawal, debit card purchase, check payment, direct deposit, interest earned, or bank fees.

- Reference Number: A unique identifier for the transaction, helpful for tracing it back to its source.

- Amount: Shows the dollar amount debited or credited to your account.

Understanding Transaction Descriptions:

Understanding these descriptions is key. Here's a breakdown of some common types:

- ATM Withdrawal: Money withdrawn from an ATM. Look for the ATM location if provided.

- Debit Card Purchase: Money spent using your debit card. The description may include the merchant name or a generic term like "scannable fake ids."

- Check Payment: A check written and cleared from your account. The payee (recipient) might be listed.

- Direct Deposit: Money electronically deposited into your account, often from your employer or a benefit program.

- Interest Earned: Interest accrued on your account balance. This may be minimal, depending on the account type and interest rate.

- Bank Fees: Charges levied by the bank for various services, like monthly maintenance fees or ATM withdrawal fees.

3. Account Activity Summary:

This section might provide a quick overview of your account activity for the period. It could include:

- Total Deposits: The sum of all credits in your account.

- Total Debits: The sum of all withdrawals and debits.

- Net Change: The difference between total deposits and debits. This should equal your ending balance minus the beginning balance.

4. Additional Information:

Some statements might include additional information like:

- Minimum Balance Requirement: If your account has a minimum balance requirement to avoid fees, this section will highlight it.

- Available Balance: This shows the amount of money readily available to spend, which might be lower than your current balance if some transactions are pending.

- Contact Information: Provides fake documents contact details for customer service if you have any questions about your statement.

Understanding Your Bank Statement Benefits:

- Track Spending: Bank statements allow you to monitor your spending habits and identify areas for potential savings.

- Reconcile Accounts: By comparing your statement with your personal records (checkbook or expense tracker), you can ensure all transactions are accurate and identify discrepancies.

- Manage Budget: Using your statement, you can analyze your income and expenses to create and maintain a realistic budget.

- Detect Fraudulent Activity: Regular review of your statements helps detect unauthorized transactions, allowing you to report them to the bank promptly.

- Tax Preparation: Statements can be helpful references when filing tax returns, especially for documenting interest earned or fees incurred.

Maximizing Your Bank Statement Usage:

- Go Paperless: Consider opting for online statements which are more secure and environmentally friendly. You can still download or print them for reference.

- Categorize Transactions: Many online banking platforms allow you to categorize transactions (groceries, rent, etc.), aiding in budget planning.

- Set Alerts: Many banks offer text or email alerts for specific events like low balance or large transactions.

- Keep Records: Maintain digital or paper copies of your statements for easy access and potential future reference.

By understanding the content of your bank statement and utilizing its features, you can take control of your finances and make informed financial decisions. Remember, a bank statement is a powerful tool that empowers you to achieve your financial goals.

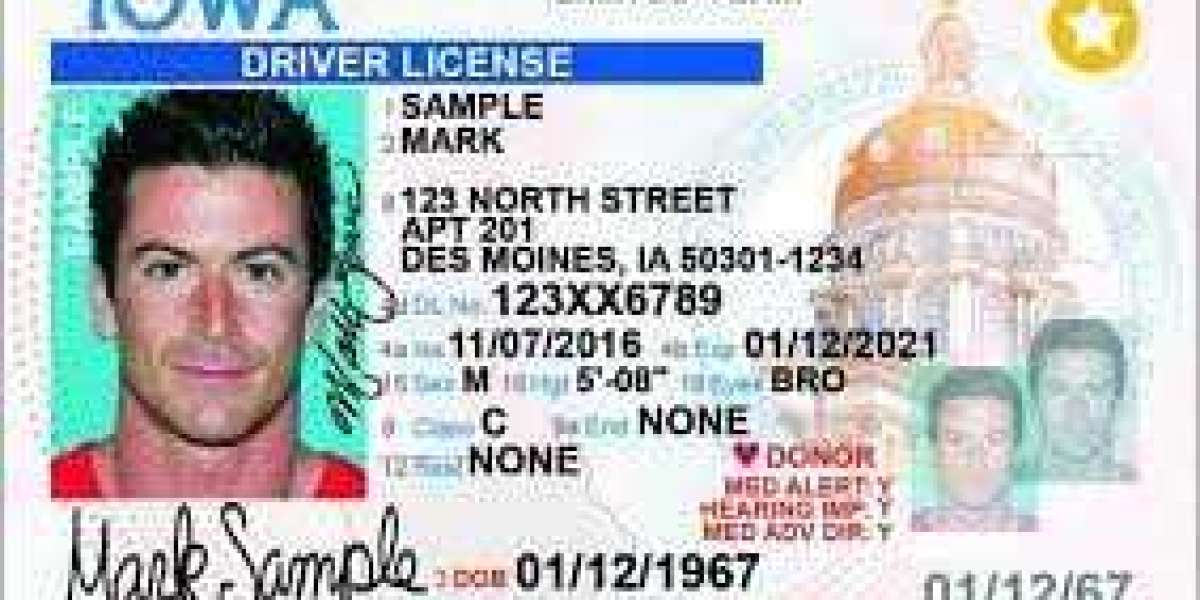

Visti: fake driving licence generator

Visit: novelty drivers license