Ethylene oxide (EO) is a critical intermediate chemical used primarily in the production of ethylene glycol, which is a key ingredient in antifreeze, polyester fibers, and polyethylene terephthalate (PET) resins. Understanding the ethylene oxide price trend is crucial for industries dependent on this chemical. This article provides an in-depth analysis of the historical price trends, the factors influencing these trends, and a forecast for 2024.

Historical Price Trends (2023-2024)

Global Overview

In 2023, the global ethylene oxide market experienced significant price fluctuations influenced by various factors such as raw material costs, geopolitical events, and demand from key industries.

North America: The price trend for ethylene oxide in North America showed mixed movements. Prices declined early in the year due to regulatory pressures from the Environmental Protection Agency (EPA) regarding the health risks associated with ethylene oxide emissions. However, prices surged later due to limited supply caused by production halts and feedstock shortages. By the end of Q1 2023, prices were around $1515 per metric ton.

Europe: In Europe, ethylene oxide prices were initially stable but began to increase due to the European Union's ban on seaborne imports of Russian crude oil, which affected the availability of feedstock ethylene. Prices climbed mid-quarter as demand remained consistent from downstream industries like monoethylene glycol. By the end of Q1 2023, prices in Germany hovered at $1495 per metric ton.

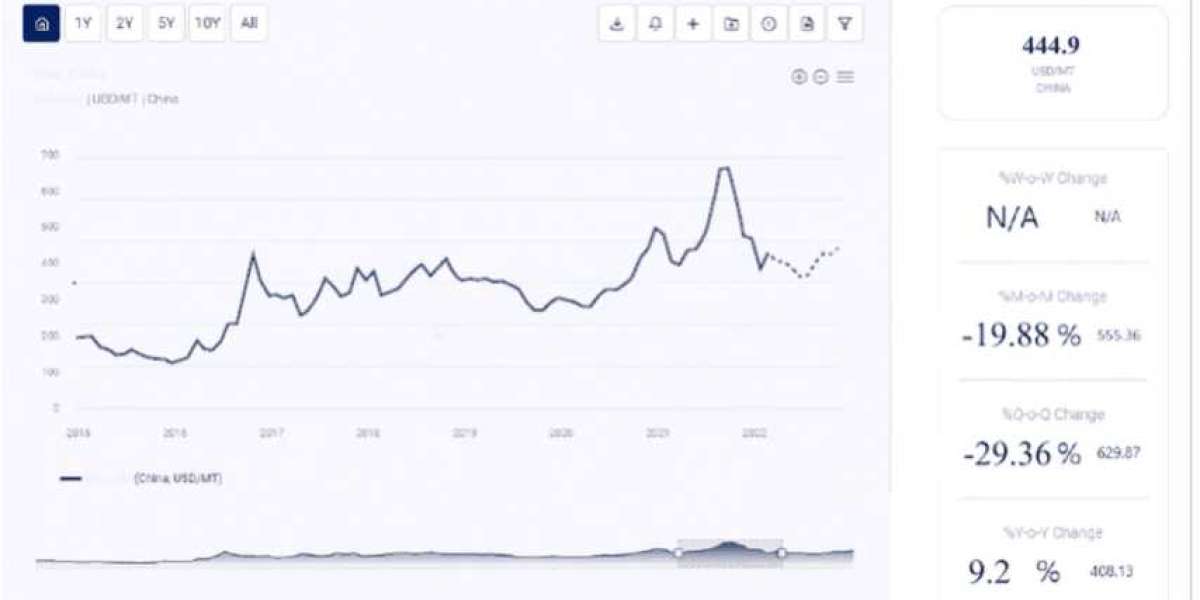

Asia: The Asian market experienced a volatile trend with prices initially dropping due to ample supply and sluggish demand. However, prices later increased due to supply constraints and rising crude oil prices, with prices in China and Japan reaching $1055 and $1035 per metric ton, respectively, by the end of Q1 2023.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/ethylene-oxide-price-trends/pricerequest

Factors Influencing Ethylene Oxide Prices

1. Raw Material Costs

The cost of ethylene, the primary feedstock for ethylene oxide, plays a significant role in determining its price. Fluctuations in crude oil prices directly impact ethylene costs. For instance, the rise in crude oil prices due to geopolitical tensions, such as the war in Ukraine, has led to increased production costs for ethylene and subsequently ethylene oxide.

2. Supply Chain Dynamics

Supply chain disruptions, including plant shutdowns and maintenance activities, significantly affect the availability and price of ethylene oxide. In North America, production halts at major facilities like Dow Plaquemine and LyondellBasell's Bayport plant in Texas contributed to price increases due to reduced supply.

3. Regulatory and Environmental Pressures

Regulatory measures, especially those related to environmental and health concerns, have a direct impact on production costs and market sentiment. The EPA's regulations on ethylene oxide emissions in the United States, highlighting its carcinogenic potential, have influenced market prices by reducing production capacity.

4. Demand from Downstream Industries

The demand for ethylene oxide from industries such as antifreeze, polyester fibers, and solvents is a major determinant of its price. Economic slowdowns or growth spurts in these industries can significantly influence market dynamics and pricing trends.

Price Forecast for 2024

Expected Price Range

Analysts predict that ethylene oxide prices will continue to exhibit volatility in 2024, with an expected trading range between $1300 and $1600 per metric ton. This forecast takes into account potential improvements in economic conditions, stable demand from key industries, and fluctuations in raw material costs.

Potential Scenarios

Optimistic Scenario: If global economic conditions improve and demand from downstream sectors like antifreeze and polyester fibers increases, prices could trend towards the higher end of the forecast range ($1500 to $1600 per metric ton).

Pessimistic Scenario: Conversely, if economic growth slows and demand decreases, prices might settle at the lower end of the forecast range ($1300 to $1400 per metric ton).

Strategic Insights for Stakeholders

For Consumers

Consumers can manage costs by securing long-term contracts with suppliers during periods of lower prices. Bulk purchasing and strategic inventory management can also help mitigate the impact of price volatility.

For Producers

Producers should focus on optimizing production processes and maintaining stable supply chains. Investing in sustainable practices and diversifying sources of raw materials can help mitigate the impact of price fluctuations.

For Traders and Investors

Traders and investors should closely monitor market trends and geopolitical developments. Utilizing financial instruments such as futures contracts can help hedge against price volatility. Staying informed about market dynamics will be crucial for making informed trading decisions.

Conclusion

The ethylene oxide market in 2024 is expected to be influenced by a complex interplay of supply chain dynamics, raw material costs, and demand from key industries. While prices are anticipated to remain relatively stable with potential for moderate increases, strategic planning and adaptability will be essential for stakeholders to navigate the market effectively. By understanding the underlying factors and staying informed about market trends, consumers, producers, and traders can make better decisions and capitalize on emerging opportunities in the ethylene oxide market.